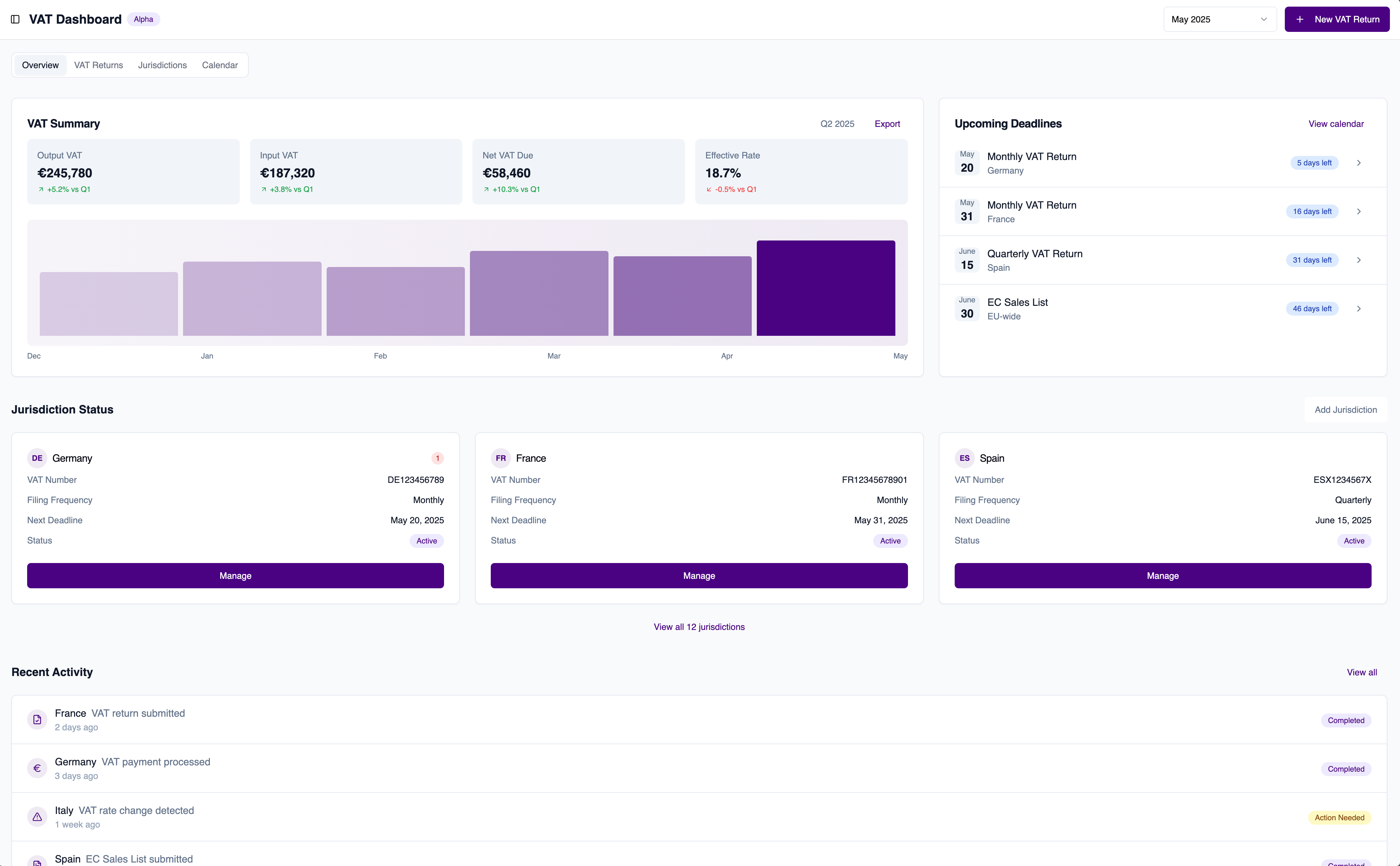

Navigate VAT Compliance with Confidence

SOVERN::VAT provides a comprehensive solution for tracking, calculating, and reporting Value Added Tax to meet EU VAT regulation.

VAT Compliance Features

Our platform provides everything you need to navigate the complexities of the EU Value Added Tax regulatory requirements.

VAT Rate Tracking

Automatically track and apply the correct VAT rates across all EU member states and other global jurisdictions.

Compliance Verification

Ensure your reporting meets all EU VAT requirements with built-in verification and validation tools.

Automated Reporting

Generate VAT-compliant reports with a single click, ready for submission to tax authorities.

Cross-Border Transactions

Easily manage VAT for cross-border transactions with automated place of supply determination.

VAT Recovery

Maximize VAT recovery opportunities and reduce financial impact with our intelligent recovery system.

Regulatory Updates

Stay current with automatic updates as VAT regulations evolve, ensuring continuous compliance.

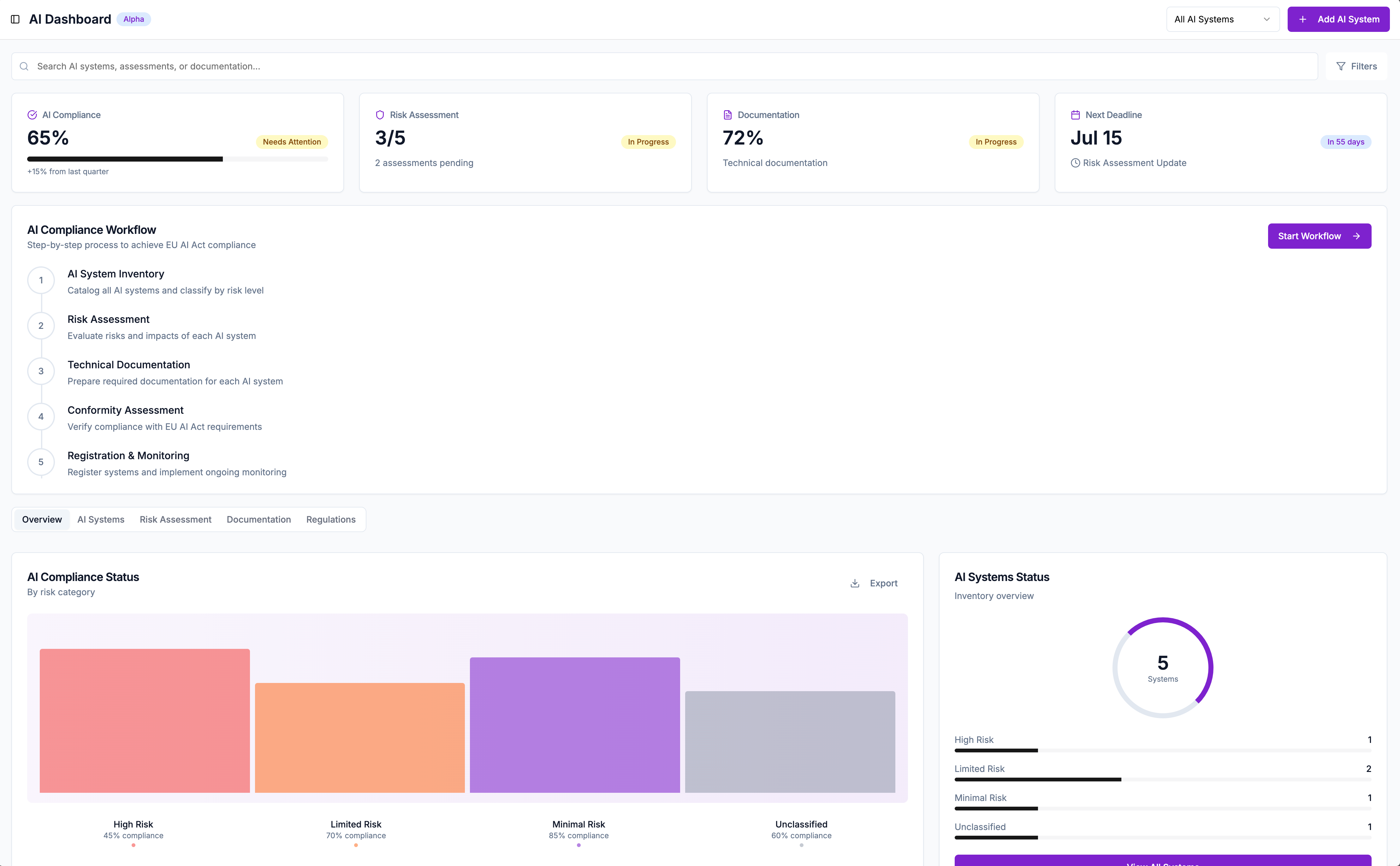

How SOVERN::VAT Works

Our streamlined process makes VAT compliance straightforward and efficient.

Data Collection

Connect your existing systems or manually input data about your transactions, invoices, and cross-border sales.

VAT Calculation

Our platform automatically calculates VAT using country-specific rates and rules.

Verification & Validation

Built-in checks ensure your data meets VAT requirements before submission.

Report Generation

Generate compliant VAT reports ready for submission to tax authorities.

Reduce Compliance Time

By up to 80%

Why Compliance Matters

VAT compliance is essential for business operations across the EU and beyond. Non-compliance can result in severe penalties and operational disruptions.

Regulatory Protection

Avoid VAT penalties, interest charges, and potential criminal liability through proper compliance management.

Investor Confidence

Demonstrate strong financial controls and tax governance to investors and stakeholders.

Stakeholder Trust

Build trust with customers, suppliers, and partners through transparent tax practices.

Global Standards

Align with international VAT standards and cross-border trade requirements.

Operational Excellence

Streamline tax processes and improve efficiency through automated compliance systems.

Risk Mitigation

Reduce exposure to tax audits, disputes, and reputational damage from compliance failures.

The Cost of Non-Compliance

Annual VAT gap in the EU

Typical penalty rates for VAT violations

Average time to resolve VAT disputes

Check Your Eligibility

Answer a few questions to determine if your organization needs to comply with VAT regulations and how our solution can help.

Do you sell goods or services to customers in the European Union?

VAT applies to businesses selling goods or services to customers in EU countries.

Transparent pricing for every scale

Choose the plan that fits your organization's regulatory needs, from startups to enterprise-scale operations.

Starter

Essential VAT compliance tools for small businesses with limited cross-border transactions.

- Up to 5 EU countries

- Up to 5 users

- Basic reporting

- Email support

- API access

- Custom integrations

Professional

Comprehensive VAT solution for medium-sized businesses with significant cross-border operations.

- All EU countries

- Up to 20 users

- Advanced reporting & analytics

- Priority support

- Basic API access

- Custom integrations

Enterprise

Tailored VAT compliance solutions for large enterprises with complex global operations.

- Global coverage

- Unlimited users

- Custom reporting & dashboards

- Dedicated account manager

- Full API access

- Custom integrations

Need a custom solution?

Our team can create a tailored compliance package based on your specific regulatory needs and organizational structure.

Volume Discounts

Special pricing available for industry associations, trade groups, and multi-entity organizations.

Public Sector Pricing

Dedicated pricing models for government agencies, tax authorities, and public institutions.

Startup Program

Special pricing and support for early-stage companies navigating their first VAT compliance challenges.

Frequently Asked Questions

Get answers to common questions about VAT compliance and our tax management solutions

Which EU VAT regulations does Sovern::VAT cover?

How does automated VAT return filing work?

Can I handle multiple VAT registrations?

How do you handle VAT rate changes?

What about VAT on digital services?

Do you provide audit support?

Ready to Simplify Your VAT Compliance?

Streamline VAT compliance with SOVERN::VAT.